The Federal Reserve faces a dilemma it cannot easily escape. With the labor market slowing sharply and inflation refusing to settle, Chair Jerome Powell and fellow policymakers on the Federal Open Market Committee (FOMC) appear set to cut interest rates on Wednesday. Yet the very move designed to cushion the economy could revive ghosts of the 1970s: stagflation, the toxic mix of rising prices and shrinking job opportunities.

Source: FactSet

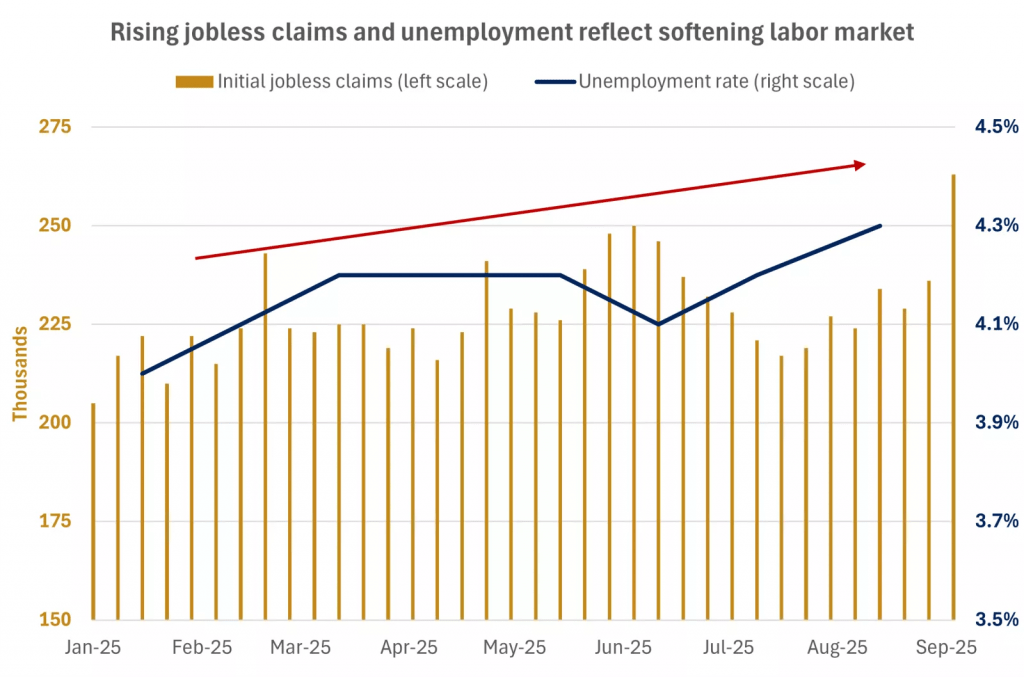

The U.S. economy added just 22,000 jobs in August, and broader employment revisions confirm a cooling labor market. Construction, manufacturing, and services are no longer immune to layoffs. Powell has admitted that the Fed’s two mandates—stable prices and full employment—are now in tension. A rate cut may ease borrowing costs, but it risks accelerating inflation already fueled by tariffs and persistent price pressures.

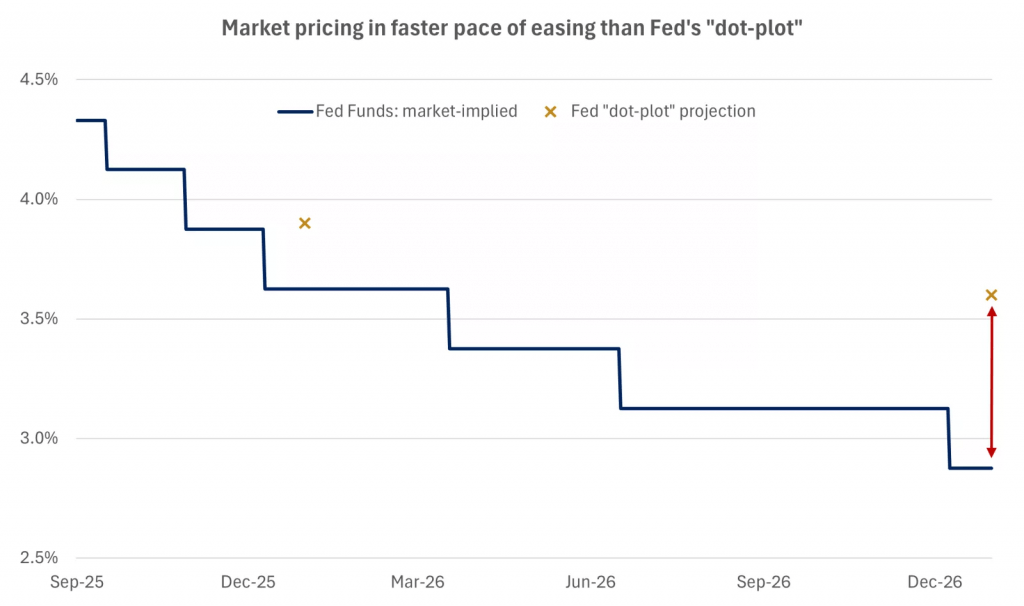

The market’s conviction that the Federal Reserve will soon begin a series of interest rate cuts is the key factor fueling gold’s ascent. This expectation is rooted in recent weak labor data, which has led many to anticipate a more accommodating monetary policy. The market has fully priced in a 25-basis-point rate cut, with a small number of traders even speculating about a larger 50-basis-point reduction.

How Deep Could the Fed Go?

Policymakers are divided on the scope of action. A quarter-point cut is widely expected, but some officials argue that the slowdown justifies a bolder move. Governor Christopher Waller has warned that labor market weakness could spread quickly, leaving the Fed “behind the curve.” Others, such as former Philadelphia Fed President Patrick Harker, have urged caution, noting that inflation driven by tariffs may not be easily contained by softer demand.

The debate highlights a fundamental problem: no one knows where the “neutral rate” of interest truly lies. If rates remain overly restrictive, the Fed risks choking growth. If it cuts too aggressively, it may unleash another inflationary spiral. The margin for error is razor-thin.

Will Consumers Even Feel the Relief?

For households, the promise of easier borrowing may prove underwhelming. Credit card and auto loan rates are unlikely to fall enough to ease pressure on consumers already worried about job security. Mortgage costs may also stay elevated as government deficits keep long-term Treasury yields high. This disconnect—between policy moves at the Fed and the borrowing costs that matter most to families—could fuel discontent and skepticism about whether monetary policy is still an effective shield.

The Bigger Risk: Policy Paralysis

The Fed’s predicament underscores a larger vulnerability. If inflation drifts higher while unemployment climbs, the central bank will find itself boxed in with few tools left to stabilize the economy. That scenario would test not only Powell’s leadership but also public faith in the Fed’s ability to manage crises.

Source: U.S. Federal Reserve, CME FedWatch

The coming months will reveal whether the September cut is a first step toward steady relief or the beginning of a perilous gamble. Either way, investors, businesses, and households should tread carefully. Uncertainty, not clarity, is the Fed’s most reliable product right now.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations