A complex interplay of economic data, geopolitical developments, and central bank pronouncements prevailed, resulting in shifts across various asset classes. From fluctuating Treasury yields and evolving sector leadership to the resurgence of European equities, the steady ascend of gold prices, and fresh sanctions impacting commodities, investors navigated a landscape rife with both opportunities and uncertainties.

This recap summarizes the key movements in the performance of US dollar, stocks, the euro, pound sterling, cryptocurrencies, and commodities.

Dollar Dynamics: Navigating Mixed Signals and Strength, Awaiting Key Data

The dollar experienced a volatile week, influenced by a mix of positive economic data and cautious Federal Reserve commentary. Robust retail sales and manufacturing activity initially strengthened the dollar, supported by rising Treasury yields, particularly the 10-year note, which attracted international investors to dollar-denominated assets.

However, concerns about future inflation and its potential impact on consumer spending, coupled with mixed messages from Fed officials, created uncertainty. DXY reflected this volatility, ultimately retreating slightly by week’s end. Despite this pullback, the dollar generally strengthened.

Stock Market: A Shift in Sentiment, Sector Leadership, and Dependence on Key Earnings

Equity markets faced a challenging week, with major indices, Dow Jones, experiencing significant declines. A disappointing forecast from retail giant Walmart, citing concerns about consumer behavior and global economic conditions, triggered a broad sell-off. Weakening consumer spending data and rising jobless claims further fueled negative sentiment. The Dow’s sharp drop below key support levels signaled growing investor apprehension about the economic outlook. While some sectors, defense, saw gains due to geopolitical developments (particularly related to increased defense spending expectations in Europe), the overall market tone was cautious.

Eurozone Developments: Balancing Growth, Uncertainty, Mixed Signals, and New Sanctions

European markets saw a slight increase on Friday but were on track for a weekly loss due to mixed business activity data. Germany saw a pick-up, while France reported contraction, creating uncertainty about the Eurozone’s growth trajectory. Geopolitical risks, including trade tensions and defense spending concerns, weighed on sentiment. Increased defense spending expectations led to higher European bond yields, as governments may issue more debt to fund military budgets. Concerns over proposed tariffs on European imports also dampened investor sentiment. The EuroStoxx 50 index, representing European equities, likely reflected these mixed economic signals. The EU’s latest wave of sanctions against Russia, targeting energy and metals, raise further questions about their impact on commodity markets and the European economy.

Sterling: Riding the Wave of Consumer Spending, but Facing Headwinds and Uncertainty

The pound reached a two-month high in January due to strong UK consumer spending data, despite concerns about declining employment trends. However, the rally was tempered by economic uncertainties and the Bank of England’s cautious rate outlook. Retail sales surged, but indicators like the PMI employment index indicated potential labor market weaknesses. Employment decline is partly due to recent tax increases on employers.

Cryptocurrencies: Fed Policy Factor, Long-Term Vision, Macro Headwinds, and Regulatory Scrutiny

Bitcoin’s third consecutive day of gains was halted by the Federal Reserve’s interest rate policy, which typically reduces risk appetite and liquidity in speculative assets like cryptocurrencies. Despite these macro headwinds, Bitcoin’s steady gains suggest investors are weighing its long-term potential against short-term monetary policy risks. Block Inc.’s Q4 earnings and increased regulatory scrutiny further exacerbate the challenges faced by the sector.

Commodities: Gold’s Safe-Haven Appeal, Oil’s Geopolitical Dance, Aluminum’s Limited Reaction, and Fort Knox Audit

Gold prices dipped slightly on Friday, but the upward trend remained strong due to strong safe-haven demand amid global uncertainties. Geopolitical instability and economic growth concerns have fueled gold’s appeal as a safe store of value. The US Administration’s trade policies, perceived as potentially inflationary, have further fueled this demand.

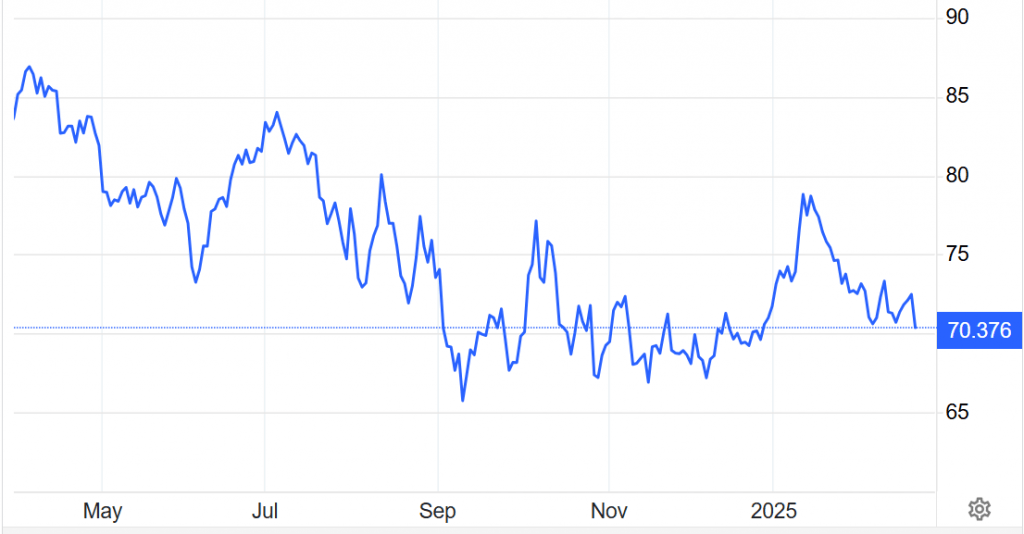

Oil benefits greatly from rising geopolitical tensions, especially in the Middle East – Oil prices in late 2024 – Source: US Energy Information Administration

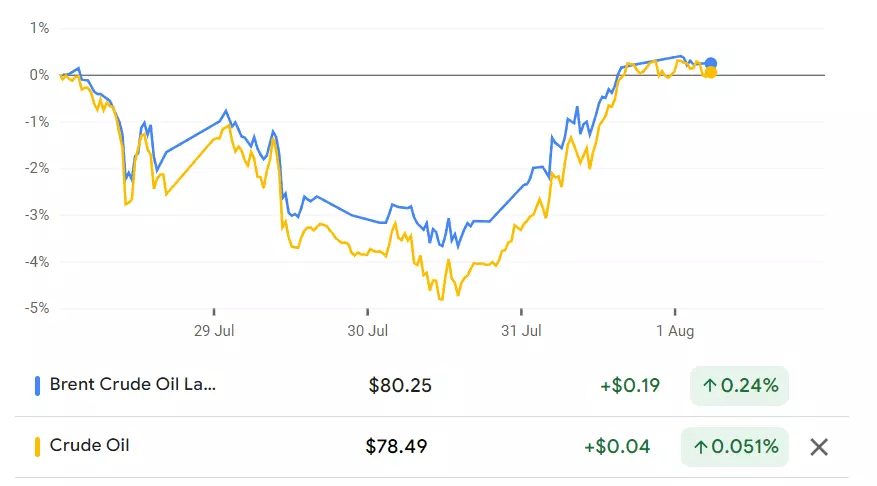

Crude oil prices are steady, with investors monitoring supply chain disruptions in Russia and a decline in US gasoline and distillate stockpiles. Geopolitical risks, including the ongoing conflict in Ukraine and potential US-Russia relations shifts, and uneven business activity data contribute to price volatility. The EU’s new sanctions against Russia and the ban on Russian primary aluminum imports in the aluminum market have further exacerbated these uncertainties.

Oil has been falling recently due to a decline in geopolitical tensions – Source: tradingeconomics

FOMC Meeting Minutes Echo Familiar Themes, Impact Market Sentiment

The FOMC minutes from the January 28-29 policy meeting, which included the Fed’s statement, press conference, and testimony, emphasized the need for a wait-and-see approach before making any changes to the current interest rate. The central bank’s language also suggested a determination to cut rates and continue quantitative easing, conditional on certain developments. Markets strongly priced in the minutes, and while keeping the federal funds rate unchanged would have favored US Treasury yields, they declined due to the lack of new information. The minutes stated that the risks to the achievement of the Fed’s dual mandate were largely balanced, but two participants believed the risks to price stability were stronger than the second part, achieving maximum employment.

Next Week: Navigating a Complex and Uncertain Landscape, with Key Data and Earnings on the Horizon

The market is characterized by complex and unpredictable landscapes due to economic data, geopolitical events, and central bank policies. Investors are closely monitoring economic growth, inflation, and monetary policy direction. The upcoming PCE data and Nvidia earnings will shape market sentiment. Navigating uncertainty and maintaining a diversified portfolio are crucial for investment success in the coming weeks and months.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations