The ECB’s Looming Decision: Navigating Complexities of Monetary Policy

The European Central Bank (ECB) is faced with a crucial decision at its upcoming meeting: whether to lower interest rates or maintain a cautious stance. This choice is fraught with complexities as the ECB must balance the need to stimulate economic growth with the imperative to combat inflation and address the prevailing concerns of a return to recession in the Eurozone.

Overall Economic Landscape

The Eurozone economy has demonstrated a remarkable degree of resilience, with GDP growth surpassing expectations. However, geopolitical tensions, potential disruptions in energy supplies, and the lingering effects of the pandemic pose significant risks.

Inflationary Pressures

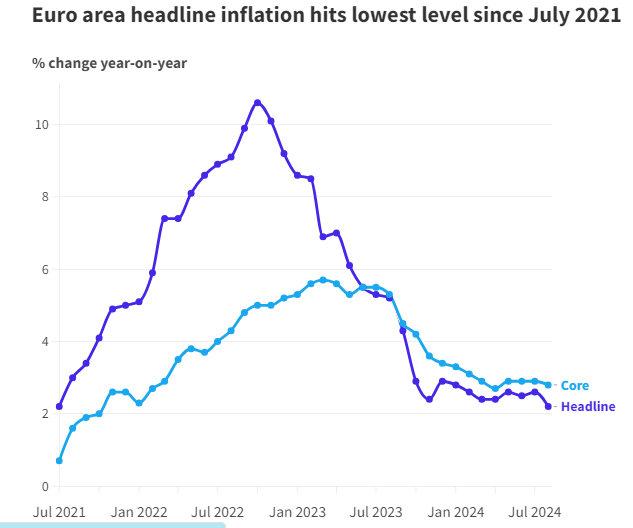

Inflation in the Eurozone has been on a downward trajectory. While headline inflation has decreased, core inflation, excluding volatile food and energy prices, remains persistently high. The ECB must prevent inflation from spiraling out of control while avoiding premature tightening of monetary policy that could stifle economic growth.

Global Context

The recent shift by the Federal Reserve towards lower interest rates has created a more favorable external environment for the ECB. Nevertheless, the global economy remains fragile, and any significant deterioration could have spillover effects on the Eurozone.

Market Expectations

Financial markets overwhelmingly anticipate the ECB to announce a rate cut at its upcoming meeting. However, the magnitude of the cut and the accompanying statement will be closely scrutinized for clues about the ECB’s future policy intentions.

Financial markets are widely expecting the European Central Bank (ECB) to announce a rate cut at its upcoming meeting. However, the size of the cut and the accompanying statement will be closely scrutinized for clues about the bank’s future policy intentions.

The ECB is poised to reduce interest rates by 25 basis points on Thursday, just days before the US Federal Reserve begins its rate-cutting cycle. Traders are anticipating rate cuts at both the Fed’s September 17-18 meeting and the ECB’s meeting this week. Thursday’s rate cut is expected to be largely uncontroversial. Most ECB spokesmen have reaffirmed their willingness to cut rates, with some policymakers supporting a cut unless evidence suggests otherwise.

Eurozone inflation has declined further, with the headline figure reaching a three-year low of 2.2% in August. The Frankfurt-based ECB will release a new round of staff forecasts next Thursday, and some economists predict a less optimistic outlook for Eurozone growth compared to July. The ECB has faced criticism for being “too slow” to stimulate growth, as confidence remains weak and the services sector struggles.

Most analysts expect the ECB to pause its rate cuts in October when policymakers meet in Ljubljana, Slovenia. However, there is a low probability that the bank will decide to cut rates sooner rather than later. Maintaining rates at excessively high levels carries inherent risks, and the consensus within the ECB’s Governing Council has shifted towards greater optimism that the bank is on track to achieve its 2% inflation target. The ECB is almost certain to cut interest rates by 25 basis points in its imminent decision.

The ECB’s Method

According to recent statements by ECB board members, policymakers in the Eurozone should proceed “gradually and cautiously” in easing monetary policy. Despite the recent progress in addressing inflation, challenges remain. The ECB currently projects inflation to return to its 2% target by the end of 2025.

What’s Next

The ECB’s decision will likely have far-reaching implications for the Eurozone economy and global financial markets. A successful outcome requires a delicate balance and a clear understanding of the complex interplay between monetary policy, economic growth, and price stability.

Additional Considerations

Beyond the immediate decision on interest rates, the ECB also faces numerous other challenges:

Quantitative Tightening: The ECB has been unwinding its balance sheet through quantitative tightening, which involves reducing its holdings of government bonds. This process can impact market liquidity and interest rates.

Financial Stability: The ECB must monitor financial stability risks, such as asset bubbles and credit growth, to ensure the stability of the financial system.

Climate Change: The ECB has recognized the importance of climate change and has begun incorporating climate-related risks into its monetary policy framework.

Technological Advancements: The rapid pace of technological change, such as artificial intelligence and automation, presents both opportunities and challenges for the Eurozone economy. The ECB must consider how these developments will impact inflation, growth, and financial stability.

Demographic Trends: Aging populations and declining birth rates in many Eurozone countries could pose long-term challenges to economic growth and financial sustainability. The ECB must take these trends into account in its policy decisions.

Geopolitical Risks: Ongoing geopolitical tensions, including the war in Ukraine and the competition between the United States and China, can create uncertainty and disrupt global trade and investment flows. The ECB must assess the potential impact of these risks on the Eurozone economy.

The ECB’s decision on interest rates will not only affect the Eurozone economy but will also have global repercussions. Any missteps could reignite economic uncertainty and financial market volatility.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations