Financial markets experienced extreme volatility this summer, with notable corrections in August and an impressive resurgence. Geopolitical worries, economic statistics, corporate results, and expectations for monetary policy were some of the causes that drove volatility.

Depending on the index, August’s market movement was akin to a summer action film, with equities closing at or close to record highs. But before this, U.S. stock prices saw a correction of about 10%, while Canadian stocks saw a decline of 5%.

Eurozone, United States

The euro has weakened and the dollar has strengthened due to the differences in economic performance between the US and the Eurozone. Investors are keeping a close eye on events in both regions as well as the results of central banks’ monetary policy decisions. Even though there was room to progressively loosen policy if inflation continued to decline, some ECB policymakers remained hesitant about decreasing borrowing costs anytime soon. They also stressed that positive data points would also need to be received in order for rates to be lowered in September. It is evident that there is a need to exercise prudence when it comes to prematurely decreasing interest rates, as there are still inflationary pressures present.

September’s financial markets should continue to be erratic, with possible fluctuations in the prices of gold, crude oil, and important currencies. Making educated investing selections requires keeping up with the most recent events in the market and in the economy.

Inflation in the Eurozone is almost at target, but some policymakers are still wary. The Eurozone’s headline annual inflation rate dropped from 2.6% in July to 2.2% in August, marking the lowest level in three years and just beyond the ECB’s 2% objective. A year ago, there were higher energy costs, which contributed to the reduction. Core inflation, which takes energy and food prices out of the equation, decreased slightly from 2.9% to 2.8%. But officials are keeping a tight eye on services inflation, which dropped from 4.0% to 4.2%.

The US economy, on the other hand, showed resiliency; the GDP for the second quarter was revised up from 2.8% to 3.0%. This strong growth number supported the dollar, as did a drop in weekly unemployment claims. The Personal Consumption Expenditures (PCE) price index, the US Federal Reserve’s favored inflation gauge, is also anticipated to exhibit cooling signals, which may open the door for future interest rate reductions.

Tech Titan Test, AI Still Robust

In August, NVIDIA—often praised as the world’s most significant stock—came face to face with reality. Tough comparisons and high valuations will probably cause the company’s development trajectory to decelerate, despite its outstanding profitability. The basic narrative surrounding artificial intelligence (AI) is still that large IT businesses, including cloud providers, are investing extensively in this technology due to a shortage of supply.

With 99% of the S&P 500 companies having already reported results, the second-quarter earnings season is largely complete. An above-average 80% of the companies have exceeded analyst estimates by 5.2%, with the index earnings growing 11.4%, a notable acceleration from the first quarter. Importantly, the full-year 2024 and 2025 earnings estimates still point to 10%+ growth for each of the two years. In Canada, TSX earnings growth turned positive for the first time since the fourth quarter of 2022, with expectations for an acceleration to double-digit growth in 2025.

Beyond tech, the market’s recovery was fueled by a broader range of sectors and stocks, indicating a shift in leadership. Earnings growth outside of the tech giants has improved, suggesting a more balanced market in the coming months. Corporate profits remain on solid ground, providing ongoing support to the bull market.

Fed’s Pivot

At the annual Jackson Hole symposium in August, the Federal Reserve (Fed) said that “the time has come for policy to adjust.” The Fed meets on September 18 and policymakers will be ready for the first rate decrease of this cycle, which will occur after 16 months of rate hikes and 13 months of keeping rates in restrictive territory. The BoC’s decision to keep easing during its meeting this week is probably due to the July core inflation number being lower than anticipated.

PCE Data Effect

As inflation makes further progress toward the 2% target south of the border, policymakers have become more sensitive to achieving the second part of their dual mandate, which is maximum employment. As they seek to engineer a soft landing, the gradual cooling of the labour market is raising some flags. The Fed’s preferred measure of inflation, the core personal consumption expenditures price index (PCE), increased 0.2% from June, the third mild increase in a row, leaving the annual pace unchanged at 2.6%1.

Oil Price Movements Amid Supply, Demand Concerns:

Crude oil prices rose slightly on Friday as investors weighed concerns over supply disruptions in Libya and Iraq, though signs of weakened demand, particularly from China, capped the gains.

Brent Crude: October futures increased by 39 cents, or 0.5%, to $80.33 a barrel. The November contract, more actively traded, rose 34 cents, or 0.4%, to $79.16.

WTI: Futures gained 30 cents, or 0.4%, to $76.21.

Both benchmarks recorded gains of over $1 on Thursday, driven by supply concerns. For the week, Brent crude and WTI are up 1.6% and 1.8%, respectively.

Libya: More than half of Libya’s oil production, approximately 700,000 barrels per day (bpd), was offline as of Thursday, with exports halted at several ports due to a standoff between rival political factions. Consulting firm Rapidan Energy Group estimates that Libyan production losses could range from 900,000 to 1 million bpd and may last several weeks.

Iraq: Iraq’s oil output is expected to decrease after exceeding its OPEC+ quota. The country plans to cut production to between 3.85 million and 3.9 million bpd next month.

Despite the supply disruptions, oil prices are still on track for declines of 0.5% and 2.2% for August, marking their second consecutive monthly drops. Worries about demand persist:

U.S. Inventory Data: A crude stock draw for the week ending August 23 was about a third smaller than expected.

China: August imports are anticipated to rise, but July’s intake of 9.97 million bpd was the lowest daily average since September 2022.

OPEC+ Plans

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, are set to gradually phase out voluntary production cuts of 2.2 million bpd from October 2024 to September 2025.

While supply issues have provided some support for oil prices, ongoing concerns about demand, particularly from key markets like China and the U.S., continue to weigh on the market. The combined effect of these factors is likely to influence price movements in the near term.

T-Yields

Bond yields have taken a dive over the past two months in anticipation of the upcoming rate-cutting cycle. As a result, more of the debate now is about how fast and how far instead of the direction of travel. Bond futures price in a 1% reduction in the Fed policy rate by year-end, followed by a 1.2% drop in 2025, implying nine rate cuts and a near 3% fed funds rate, down from 5.5% currently. In Canada bond markets anticipate three rate cuts this year and a 3% policy rate by July of 20251.

Shift From Inflation To Growth Becomes Key Factor

One of the main themes in the most recent economic data has been the change from inflation to growth. The primary way that economic data was interpreted and viewed until recently was in relation to central banks. Positive economic news may be bad for the markets, and negative economic news may be good for the markets since it suggests that inflation will continue to decline, which will force the Fed to lower interest rates and lower yields. But now that inflation is hovering around 2% and the Fed has signaled its intentions, it’s back to bad news being bad news.

Soft Landing

Despite soft-landing doubts, consumers remain resilient. During the spike in volatility in early August, our view was that the growth worries were overblown, and the economic expansion appeared poised to continue. Since then, a string of solid data (jobless claims, retail sales, services PMI, inflation-adjusted consumer spending) have once again shifted the narrative back to a soft landing as the base-case scenario for both the U.S. and Canada.

With inflation under control, the focus is shifting to economic growth for both investors and the Fed. The next two-month stretch leading to the November election day has historically been seasonally challenging for stocks. If volatility reemerges, we will lean into it. Historically, the start of a rate-cutting cycle is positive for stocks when the economy is not in a recession.

The week saw some signs of the US consumer proving resilient in the face of the cooling labour market. The Commerce Department reported that personal incomes had increased an unexpected 0.3% in July, up from June’s 0.2%. Personal spending rose even more, 0.5%, although the gain was in line with consensus. The Commerce Department also revised upward its estimate of the annualized growth in gross domestic product in the second quarter, from 2.8% to 3.0%. The increase was driven largely by a substantial upward revision in consumer spending over the quarter, from 2.3% to 2.9%.

The housing sector appeared to be the weak leg of the expansion. The National Association of Realtors reported that pending home sales had tumbled 5.5% in July, bringing them to their lowest level in records dating to 2001. The association’s chief economist attributed the drop to “affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election,” as well as some buyers expecting mortgage rates to drop as the Fed eases policy.

China

Beyond the United States, other economies are also experiencing growth and facing challenges. In Europe, the economic sentiment indicator has improved, while in China, the property sector slump and weak domestic demand are headwinds. Chinese stocks fell as a series of corporate earnings reports missed expectations and dampened buying sentiment. The Shanghai Composite Index lost 0.43%, the blue chip CSI 300 fell 0.17%, and the benchmark Hang Seng Index gained 2.14% in Hong Kong.

Several China economists reduced their 2024 growth forecasts as the country grapples with a prolonged property sector slump and weak domestic demand. Retail sales, a key consumption indicator, are estimated to grow 4% this year, down from estimates of 4.5% in July, according to a Bloomberg survey of economists. Fixed asset investment is expected to grow 4.2%, lower than the prior month’s projection of 4.4%. Economists also trimmed their consumer price index forecast to 0.5% from 0.6%. The weaker outlook for China raised the prospect that the country may miss its official growth target of about 5% this year.

On the monetary policy front, the People’s Bank of China injected RMB 300 billion into the banking system via its medium-term lending facility and left the lending rate unchanged at 2.3%. The central bank also supplemented the banking system with RMB 471 billion via its short-term seven-day reverse repos and kept the lending rate at 1.7%.

Gold Performance

Gold spot charts have seen some frothy trading within a relatively limited band of $20/ounce or so, with no steep moves until Friday morning. The good news for gold is that this cycle has lifted gold to all-time highs and a chance to consolidate support at or above $2500/ounce. However, the week ended with strong movements elsewhere in the macro complex, particularly a surge higher in both the US Dollar Index and US Treasury yields.

The market ended the summer on a positive note, driven by factors such as strong earnings, a resilient economy, and the Fed’s dovish stance. As we look ahead, the market’s performance will continue to be influenced by economic data, corporate earnings, and geopolitical events.

The final week of August saw a relatively calm period for gold prices, despite a backdrop of economic uncertainty and geopolitical tensions. The yellow metal remained within a narrow trading range, reflecting a cautious stance among investors as they awaited key economic indicators and potential policy shifts.

One of the primary factors influencing gold prices this week was the continued speculation surrounding the Federal Reserve’s monetary policy. While the central bank signaled a potential rate cut in September, investors remained uncertain about the magnitude of the reduction and its impact on the broader economy. This uncertainty contributed to a lack of clear direction for gold prices.

Additionally, the geopolitical landscape remained a source of volatility for the precious metal. Ongoing tensions between major world powers and regional conflicts continued to create a sense of unease among investors, which can often drive demand for safe-haven assets like gold. However, these geopolitical factors did not have a significant impact on gold prices during this particular week.

Economic data releases also played a role in shaping the gold market. While some indicators, such as the Durable Goods report, showed signs of economic resilience, others, like the PCE Price Index, suggested that inflationary pressures were easing. This mixed economic picture further contributed to the cautious sentiment among investors.

Overall, the week was characterized by a lack of major catalysts for gold prices. The yellow metal’s stability reflected a combination of factors, including uncertainty about the Federal Reserve’s monetary policy, geopolitical tensions, and mixed economic data. As we move into September, investors will be closely watching for key economic indicators and any developments in the geopolitical landscape that could impact gold prices.

Euro’s Performance

The Euro has experienced a significant decline following the release of data indicating a substantial drop in Germany’s consumer price index. This development, coupled with robust US economic indicators, has strengthened the dollar and put downward pressure on the euro. Germany, the largest economy in the Eurozone , reported a monthly decline of 0.1% in its consumer price index for August, falling short of market expectations and signaling easing inflationary pressures within the region. Consequently, the euro depreciated to 1.0783 against the dollar.

Pan-European STOXX Europe 600 Index gained 1.34%, rising to a record high. The benchmark extended a rally for a fourth week as sharply slower inflation supported the case for the European Central Bank (ECB) to cut interest rates in September. Among major European stock indexes, Germany’s DAX reached a fresh peak, climbing 1.47%, while Italy’s FTSE MIB added 2.15%, and France’s CAC 40 Index tacked on 0.71%. The UK’s FTSE 100 Index ended 0.59% higher.

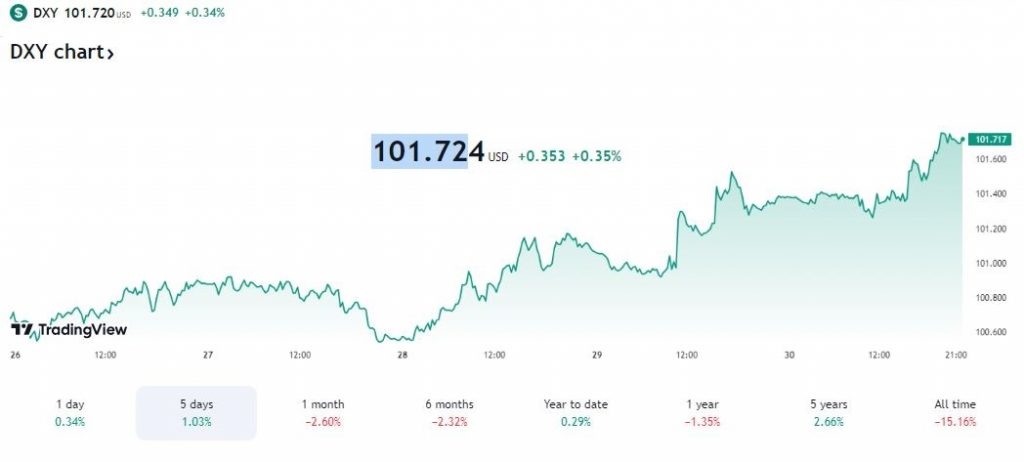

DXY Index

Dollar strength has had a ripple effect across various markets, with the dollar-yen pair, which has a strong positive correlation with US Treasury yields, also appreciated. Bond yields have risen, driven by the positive economic data and expectations of looming rate change and monetary easing. Gold prices have declined as the dollar strengthened, while US equities have generally performed well, supported by the strong economic data and positive earnings reports, particularly from tech giants like Nvidia.

Cryptocurrencies:

Cryptocurrencies, especially Bitcoin, have been impacted by the overall market sentiment and macroeconomic factors. While Bitcoin initially saw a rally, it has since faced selling pressure. Factors affecting cryptocurrency prices include regulatory uncertainty, energy consumption, and macroeconomic factors.

The New Trading Week

This week’s key economic data are the August labor force survey and the Bank of Canada’s interest rate decision. It appears that the coming week will provide gold and a sizable portion of the US share market with yet another boost.

The macro outlook for next week suggests that there will either be more aggressive headwinds or another catalyst for gold (and probably a significant portion of the US equity market as well). Regardless, it is highly unlikely to be a stolid session like most of the previous five. On Monday, after the Labor Day holiday, we will receive some important updates on economic growth via the ISM survey data. On Friday morning, we will get the August Jobs Report.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations